— By Carol DeVita and Margaret Simms, Urban Institute —

Through the Recovery Act (ARRA), the Federal government distributed $1 billion to the Community Services Block Grant (CSBG) to assist in the economic recovery effort. Many people want to know how that came out.

As co-directors of the CSBG ARRA evaluation study, we are happy to highlight the results of two recently released reports of the project that the Office of Community Services (OCS) commissioned to learn about CSBG ARRA.

First, is the “Implementation of Community Services Block Grants Under ARRA” where we looked at how the stimulus funds were used and what types of activities and investments were made. We interviewed dozens of Federal and State officials and members of the CSBG Network who were responsible for implementing CSBG ARRA. We also visited eight states (California, Georgia, Massachusetts, Minnesota, New York, Oklahoma, Virginia, and Washington) and went to several CSBG local entities in each of these States to get an on-the-ground look at their accomplishments.

The report presents the findings of an extensive evaluation to document the services, promising practices, and challenges that emerged during the CSBG ARRA initiative. ARRA represented an unprecedented infusion of funding, accompanied by increased monitoring and accountability. The lessons learned have valuable implications for the CSBG Network and suggests the need for continued and open communication among the Network’s members (from OCS down to the local agencies) to work together on finding practical solutions to common problems.

The evaluation also points out the challenges faced in implementing a quick, massive program and recommends adjustments that might benefit future government programs.

Among the challenges:

- Local CSBG grantees had to use the ARRA funds in 18 months, requiring quick ramp-up and wind-down.

- This timetable was much more compressed than was the case for most other ARRA programs.

- Implementation was more difficult because States were not given administrative funds for planning or implementing the CSBG ARRA efforts, and they had to develop new systems to comply with ARRA’s reporting requirements.

However, as ARRA was designed to do, CSBG ARRA encouraged innovation and gave local grantees an opportunity to implement new program ideas they had researched and developed, but put on hold due to a lack of regular funding.

Other benefits included:

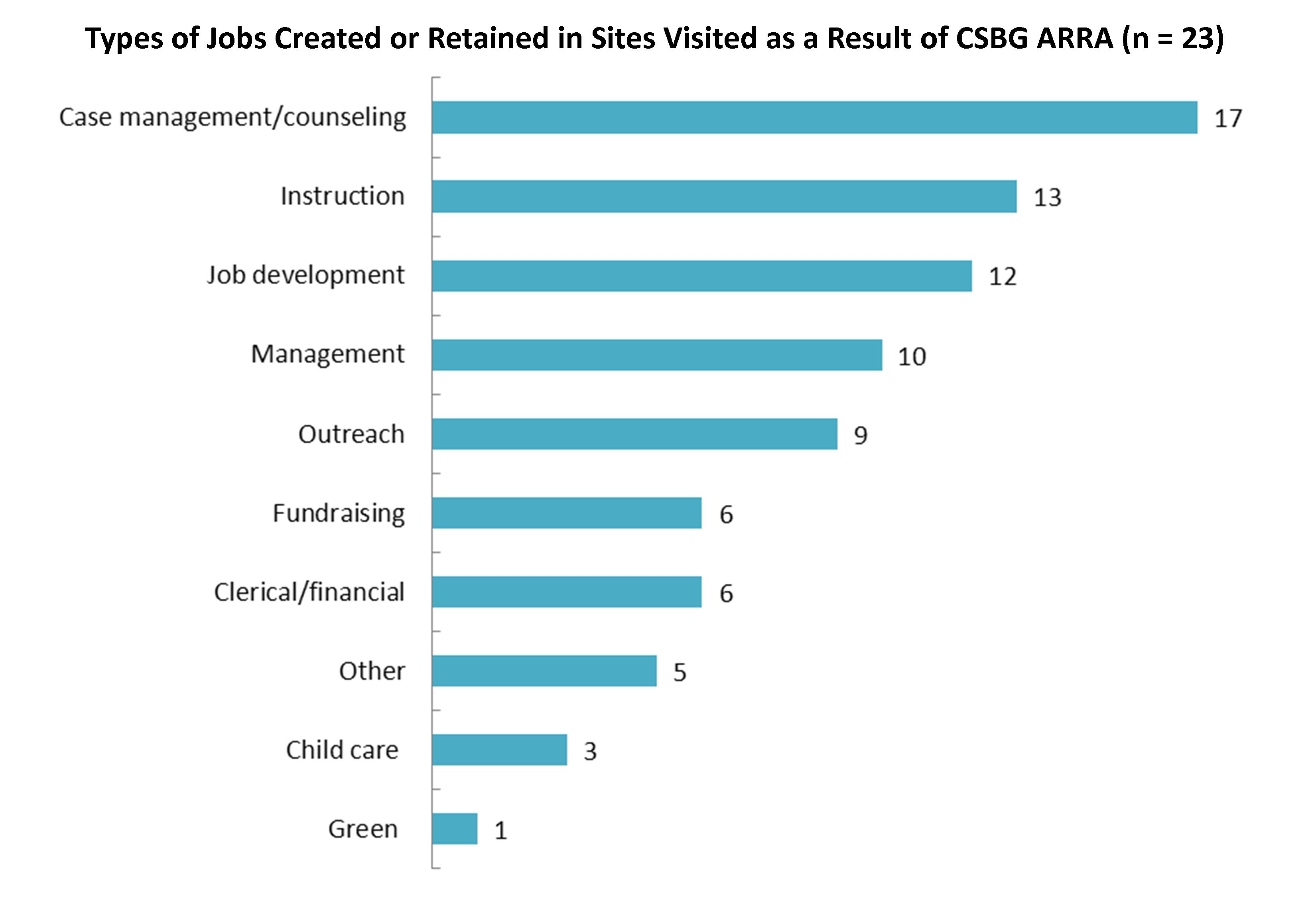

- creating or saving jobs – as many as 18,000 jobs, which is probably an undercount because of how ARRA counted jobs ;

- serving more needy families;

- improving existing programs; and

- building the capacity to deliver services more effectively.

In addition to assessing the implementation of ARRA, OCS also asked us to study CSBG administrative expenses and put this information in a broader context of how CSBG compares with similar nonprofits that don’t receive CSBG support. To do this, we looked at government regulations and administrative guidelines, analyzed IRS Form 990 data for both CAAs and comparable nonprofits, and spoke with nearly two dozen CAA financial officers to understand their perspectives on reporting administrative expenses.

A second report, “Community Services Block Grant Administrative Expenses” provides analysis on the level of administrative expenses among local CSBG grantees.

The study addressed five research questions:

- How are administrative costs defined by Federal government entities, particularly for CSBG?

- What percentage of State CSBG funds is spent on administrative expenditures?

- What types of guidance do States receive in reporting CSBG administrative costs?

- How do the administrative expenditures of CSBG-eligible entities compare to those of similar nonprofit organizations?

- How have administrative expenditures been used to assess the performance of nonprofit organizations, including the strengths and limitations of these approaches?

Overall, local CSBG grantees appear to be comparatively good stewards of their overall financial resources. On average, CAAs spent less on administrative expenses than the comparable group of nonprofits. However, the report cautions that focusing solely on financial ratios to assess an organization’s efficiency and effectiveness can miss the big picture of an organization’s performance in terms of who they serve and the types of services provided.

The report provides recommendations related to administrative expenditures, including consideration of a range of administrative expense levels based on an organization’s size.